Best Way to Save Money for Kids: Save for a Safe Future

What is the best way to save money for kids?

This topic is where parenting meets finance.

Most of your financial responsibilities lie with people you love, and our kids are at the core of our financial attention.

Financial responsibilities to your child are as important as attending to their emotional needs.

A financial plan for your child is paramount since we can’t foresee our destiny. But we can safeguard it with financial planning and savings.

With schooling and college expenses touching a new level in the sky every year, it’s best to start your savings now, and here are the best possible ways to do it.

Why do We Need to Save for a Child?

Before discussing the best way to save money for your kids, let’s learn why it’s important.

As a parent, it’s common to worry about your children’s financial security.

Be it their education or marriage, you want to safeguard the significant life events and help them sail smoothly.

And that’s where your savings for your child becomes important.

It’s even better to encourage them to do the same.

Here are a few reasons why you must prioritize savings for kids.

Firstly, education is becoming costlier, and higher education is becoming less affordable for many people.

Starting from university fees to other ancillary expenses – parents are worried about how to cover it all.

Medical inflation is also on the rise. Your child can get diagnosed with any serious medical condition. No matter the difficulty level, you can deal with such discomfort if you have enough savings.

Marriage is another major life event that needs proper financial planning. Wedding expenses are going downhill, and if you’re well prepared, it can take a toll on your finances. Having savings is the helping hand you need all along.

Things to Know if You Are Saving Money for Your Kids

Before you start investing in your kid, here are a few things you should know

1. Know What You are Saving for

The best way to tackle a problem starts with anticipating it. As you begin to understand your financial needs, you start to mitigate many of them. For example, your child’s education is a major area of expenditure.

You may have to consider tuition fees, accommodations, and other ancillary educational costs. Once you have a clear picture of what to save for, you can do your math and come up with an amount that needs saving. Now, start putting money away in dedicated savings vehicles like FDs, SIPs, etc.

Indian parents can take advantage of PPF (Public Provident Fund), which offers 7.1% in return. In addition, a scheme initiated by the government of India, Sukanya Samriddhi Yojana, offers 8% interest rate.

Parents can open an account for their daughters if they are ten years old. They can start with a minimum of Rs.1000 in investment and add up to 1.5 lakhs annually.

It’s common to assume which stream of education your child will pursue. And sometimes, it takes an unexpected turn.

Next, you can start saving accordingly. That wraps up the savings required for the things your child needs. Next up, we come to the want-base plan, where you try to secure things, your kids want.

It’s important to note essential expenditures for your kids and build your savings.

2. Open a Co-owned Savings Account & let Them Collaborate

A good parent values financial learning. An easy way to pass it on to your children and make them financially independent is by asking them to collaborate.

Many banks and financial institutions allow parents and children to open joint accounts. Co-owned savings accounts will help your child learn to manage their bank account.

In fact, some banks and financial institutions provide added benefits to kids’ savings accounts. Some yield higher interest rates for education or marriage-related savings.

Most importantly, they can get into their early habit of savings. As a parent, you can start. When your kid starts to grow up and collaborate, they can also add up to the little earnings they make.

As you start to include them in the journey, they’ll understand primary necessities like education and unforeseen incidents. This can also motivate them to learn the importance of putting money away.

Start by teaching them concepts like FD (Fixed Deposits) and RDs (Recurring Deposits).

How?

They can put away parts of their allowances and sell their old and used items. I started working distributing newspapers when I was a teenager. And there are tons of odd jobs teens can do to make money.

3. Start Early: Let Time Benefit You

The best way to save money for your kids is to start early.

University fees are skyrocketing. The cost of marriage is also high, and the inflation rate increasing every year makes it more difficult to carry out marriage expenses.

If your child is now 3 years old, they will be ready for higher education in 15 to 17 years.

This need will supposedly come at a huge expense.

So, if you start investing now, you’ll benefit from using time and compounding your investment by reinvesting your returns.

A safe future for your kid can start from today – only if you are wise enough to invest early.

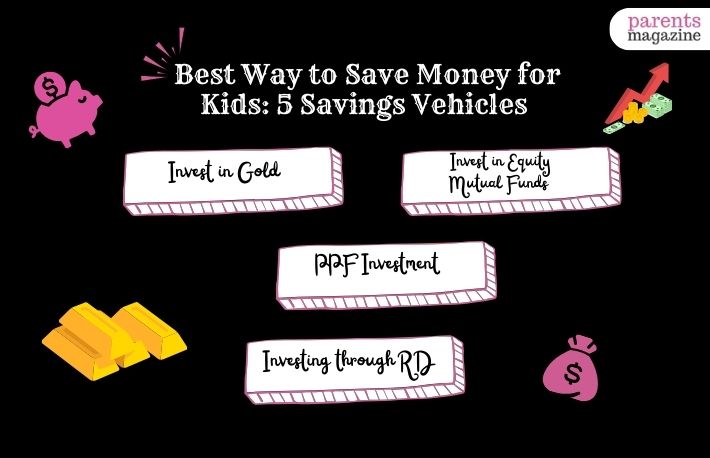

Best Way to Save Money for Kids: 5 Savings Vehicles

Here are some of the best ways you can invest for your child –

Invest in Gold

The answer is in gold investment if you want the perfect hedge against equity. It keeps your money stable in a volatile market.

No, we aren’t talking about buying and holding physical gold. Physical gold comes with the risk of storing. However, e-golds or gold mutual funds, on the other hand, are one of the best ways for kids to invest.

Why?

Well, gold has a reputation for being a steady investment. It can fight inflation forces in the long term. Plus, they come with a high level of liquidity, especially in India.

If you want to cash in your gold investments for your child’s college fees, it shouldn’t be a problem.

Invest in Equity Mutual Funds

Equity investment plans are among the highest-ranking investment plans for children. Investors mark two features of this investment vehicle as attractive –

First, investors can invest for a long time frame. It ranges between 10 to 15 years.

Second, the annual return rate for equity mutual funds has stayed below 12% to 15%.

PPF Investment

A secure and sound investment for your kids is through PPF investment.

PPF allows you to lock your money for 15 years, which is undoubtedly the best way to save money for kids – if you are considering paying for a higher education.

Investors can start with a 1 lakh per annum, and the interest rate is 8.75% per annum. Investors can go to the post office or bank to start their PPF account.

Investing through RD (Recurring Deposits)

A low-risk investment for kids is through recurring deposit investments. Some Indian parents consider RDs a healthy investment option thanks to their high interest rates.

Both the post office of India and the banks allow investors to invest in RDs. For example, if you invest Rs.1000 per month, you can expect two lakhs after 10 years of constant investment.

The Indian Post Office website has a tool to calculate the total on your monthly investment.

The Indian Government issues the National Savings Certificate to help you safeguard your child’s education. Parents can buy this certificate for a 5-year period. Then, they can reinvest in it on maturity.

The current interest rate offered for this certificate is 8.10%, and one can buy it for as little as Rs.100. Also, an investment of 1 lakh per annum can qualify for an IT rebate (under section 80C of the Income Tax Act).

Final Words

So, what’s the best way to save money for kids? As a parent, try building a corpus, a solid financial foundation for your children. The trick is to start early and try diversifying your portfolio as much as you can.

It’s also best to take advice from professionals in this area. Regardless of the type of investment you choose, ensure the merits and drawbacks of investing in a particular area. Caution should always be your best friend when you need it. However, the investment vehicles discussed in this article are worth considering for safeguarding your child’s life.

Read Also:

Already have an account?

Sign In

Create your account

User added successfully. Log in